Nicole Baudisch, IB Ambassador of Business & Economics at IB Wave, CAS & Advisory Coordinator. Head of I&S Department.

Corporations had to learn and adapt processes to a digital workplace when individuals were placed under lockdown regulations due to COVID.

Most companies are now re-imagining their core business processes with the knowledge and experience they have gained from the covid lockdowns.

Are workspaces still absolutely essential? When some organizations’ employees worked remotely, their productivity increased.

Tabla de contenidos

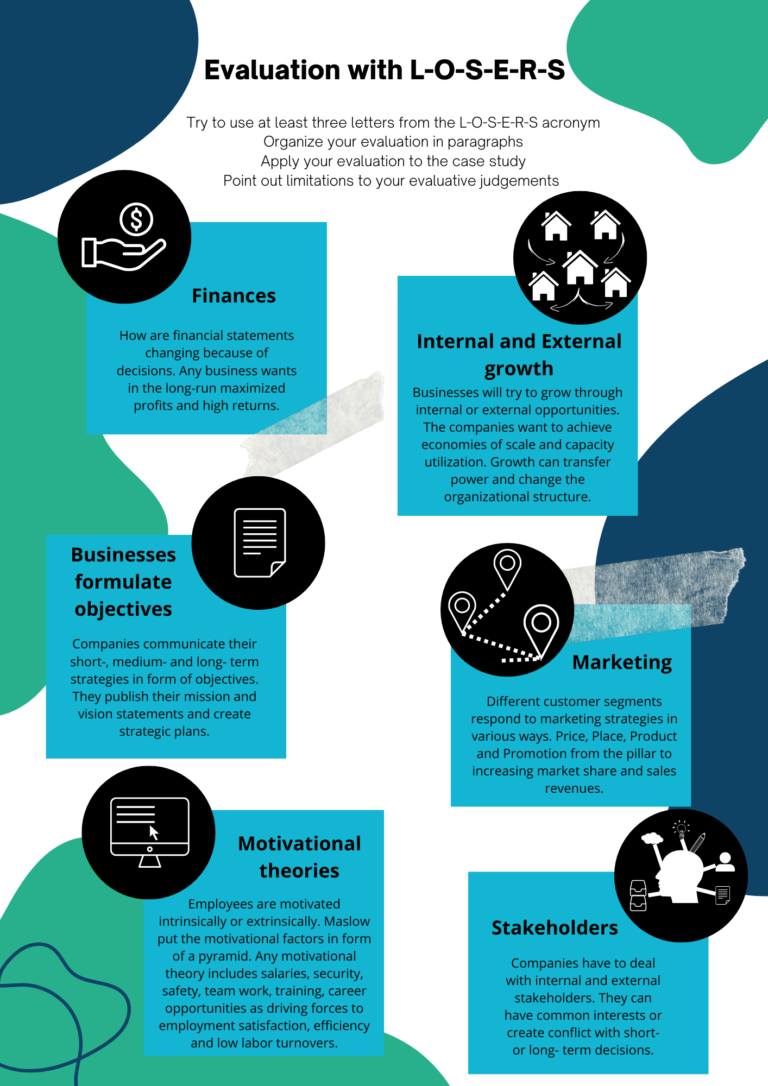

LOSERS Paragraphs

It is recommended to use at least three letters from the LOSERS acronym.

L- Long-run versus Short-run

Most decisions can have great benefits for a business in the long-run but in the short-run might require investment or changes to an established operational model.

Companies usually define their short-, medium- and long-term objectives.

On an operational level, day-to-day decisions are made quickly. These are short-run implications. Results to these decisions can be seen immediately.

In the short-run, factors of production for a company have at least one fixed component. In most business cases, this is capital also referred to as fixed assets.

These are long-term investments in form of properties, buildings, factories needed to operate on a daily basis and to generate sales revenue streams for the company.

Let’s consider the following current event:

Musk and his co-investors put up more than $30 billions of their personal capital for the Twitter transaction. The provision of $14 billion in debt financing has been committed to by a number of financial institutions, including Morgan Stanley (MS.N) and Bank of America Corp (BAC.N).

Short-Run

- As a result of the debt that Musk placed upon Twitter, the company is going to have to make interest payments on that debt in the next year that will amount close to $1.2 billion.

- To cut costs, CEO of Twitter, Elon Musk terminates over 4,400 of the company’s 5,500 contract workers and in addition laying off approximately half of Twitter’s 7,500 employees.

Long-run

- Musk announced that he plans to increase revenue to $26.4 billion by 2028.

- In 2028, advertising would generate $12 billion in revenue and subscriptions nearly $10 billion

Sources: The New York Times

There are a few key areas, IB candidates can always consider when evaluating short- and long-run impacts. Ask yourself:

- Is the business structure and liability changing?

- Is ownership changing?

- Is growth and evolution effected?

- Are their any implications on the market share now or in the future?

- Are employees taken into consideration (more, less, training, improvements, motivation, empowerment?)

- Changes to the factors of production to increase productivity

- Changes to the Marketing Mix, customer segmentation

- Changes in cost structure, cash flow or sales revenues

- Changes to the production methods

O-Objectives

One of the benefits that arises as a result of proper communication of company objectives throughout an organization, is higher levels of performance.

Because they have a better awareness of both their own personal goals and the overarching objectives of the organization, employees and managers alike are able to accomplish more.

Businesses define effectively performance criteria and metrics in accordance with the objectives they wish to accomplish by developing mission and vision statements.

Values of the company should be well-defined and quantifiable before they can be considered business objectives.

They are formulated in the form of key performance indicators (also known as KPIs), while other times they are written as SMART goals.

The competitive advantage, technological leadership, sustainability, return on investment, employee engagement and efficiency, and corporate identity of a firm are all common long-term objectives.

Examples

Siemens moved beyond a purpose of “maximizing shareholder value” to a mission of “serving society.”

Netflix changed its long-term objectives from distributing content digitally to become a leading producer of original content that could win Emmys and Oscars.

In the short-run, the aim is to increase on-time delivery from 95% to 99% in the San Jose area but the long-run strategy is to expand to all main 5 cities and migrate sales and ordering to an e-commerce platform with an investment of $250 000.

S-Internal and External Stakeholder Interests and Conflicts

A stakeholder is a person or a group with an interest in the enterprise, its activities, or organization of it.

A stakeholder group doesn’t need to have a financial interest; they can simply be impacted by or have a say in the decisions and plans the company makes.

These effects don’t always have to be undesirable; they might also be advantageous.

Shareholders are interested in the profitability of the business. By making an investment in the company, they may also stand to gain capital.

They want the business to keep expanding and earning higher profits, which will increase the dividends paid out and capital gains.

Attractive financial and non-financial benefits appeal to both management and employees.

They are also interested in a positive work atmosphere, exciting career opportunities, and substantial training and development opportunities.

Their actions have an impact on the business. Additionally, management's choices have a big influence on how well the business does.

Candidates can link to motivational theories when addressing employee interests.

IB Business Candidates should also differentiate between group and individual interests. A good way is to work out conflicts between certain managerial leadership styles and employee reaction.

Customers are interested in the products, support, and security practices offered by the business. They expect the business to provide reasonably priced, high-quality goods.

Business ethics is a different factor that is currently gaining popularity and appreciation. People prefer businesses that care about society and the environment as well as their bottom line.

Suppliers are interested in the commodities that the business purchases. They want businesses to buy from them frequently, positive payment behavior, and buy in bulk.

Suppliers aim to build long-term relationships with companies to achieve economies of scale for all stakeholders involved.

National governments need to earn tax revenues from producers and households. Companies are expected to comply with the laws and regulations.

In addition to not engaging in anti-competitive behavior or employing unfair labor practices, companies are required by the government to manage their operations in an environmentally sustainable manner.

Another point of interest is offering jobs, investing and supporting economic growth.

Financial institutions require that principal and interest payments be made promptly by the business. They are trying to prevent the business from going into further debt.

As a result, banks pay attention to elements such as the liquidity and solvency of the organization. When attempting to determine the rate of default, one more signal that can be considered is credit rating.

Financial institutions want to sign new loan contracts as well as providing financial services to companies.

IB candidates should use the gearing ratio or long-term liabilities in their evaluation.

Local communities are often concerned about environmental impacts, resource depletion, local employee exploitation and overall business practices.

They want the company to hire people from the surrounding area, be ecologically responsible in its business practices, not cause any negative externalities, and support communities with infrastructure development and public spending initiatives.

Each stakeholder involved wants to safeguard their unique objectives. They seek to guarantee that their objectives and interests are fulfilled.

However, it is impossible for businesses to meet of demands and choices have to be made. These choices depend on the business priorities.

Examples of Stakeholder Conflicts

Since stakeholders frequently have divergent and competing interests, disagreements can be expected.

When making decisions, it typically creates disadvantages for at least one stakeholder. Directors must set priorities and choose options that some stakeholders might find objectionable.

A few common examples are provided below.

Shareholders make financial investments into companies. In return they are rewarded with dividends higher yielding than interest rates.

Typically, a shareholder likes to see the investment recovered as quickly as possible. Dividends are paid out as a percentage from the net profit after tax and interest.

Salaries for employees are included in the fixed costs. The higher the fixed costs, the lower the net profit.

That said any increase will reduce either dividends or retained profits needed for financing internal growth.

Employees will get demotivated and respond with reduced productivity rates. They might work less carefully and quality can suffer in the long-run.

If the company pays less competitive salaries, it will have to deal with increasing labor turnover and less efficiency.

This leads to additional recruitment costs and loss of knowledge transfer.

The size of the company's operations and the scope of their business both rise as a result of either internal or external expansion.

New jobs are created, and naturally, the community and government in the area will support economic growth.

Conversely, investors with a short-term investment view may be dissatisfied with the decision because the expansion would result in decreased short-term profitability.

Companies need to invest additional funds to either establish new plants or purchase capital goods such as machinery and equipment.

All of this contributes to decreased levels of earnings and, as a result, dividends.

During covid, many companies had to lay off staff or reduce from full-to part-time employment to cut costs. These were survival measures taken during a recession.

Alternatively, insolvency or closure would have resulted in complete job losses. Shareholders and managers had to deal with ethical conflicts.

Another example would be automation and switching to digital platforms and AI’s. In the long-run technology will replace human employees and make them redundant.

The company might have to pay severance for contract termination but in the long-run increase productivity and cut costs.

Customers demand items that are of higher quality yet are sold at lower prices.

However, this would result in increased expenses for the corporation as well as decreased profits; shareholders and management are opposed to this possibility.

Customers like convenience, variety, promotion and to be informed.

For marketing departments, a real challenge to always stay ahead with their marketing strategies to estimate new trends and wants.

This was the first part of possible evaluation strategies using LOSERS. In the next article, IB students learn about the letters ER and S.

Those stand for external factors, Resources and Synergies.

And an important advice: always link back to the case study!

Happy Evaluating!